Mobile phone quick loan companies in Nigeria are currently on the rise. Money is a very sensitive topic all over the world and getting involved with money matter sometimes can be very stressful. In this part of the world Nigeria, not everyone has access to bank loans because of their dreadful requirements but with the fast mobile phone loan companies a lot people can have access to loans with less stress. I will be slightly discussing and listing out some mobile phone loan companies for instant loan in Nigeria.

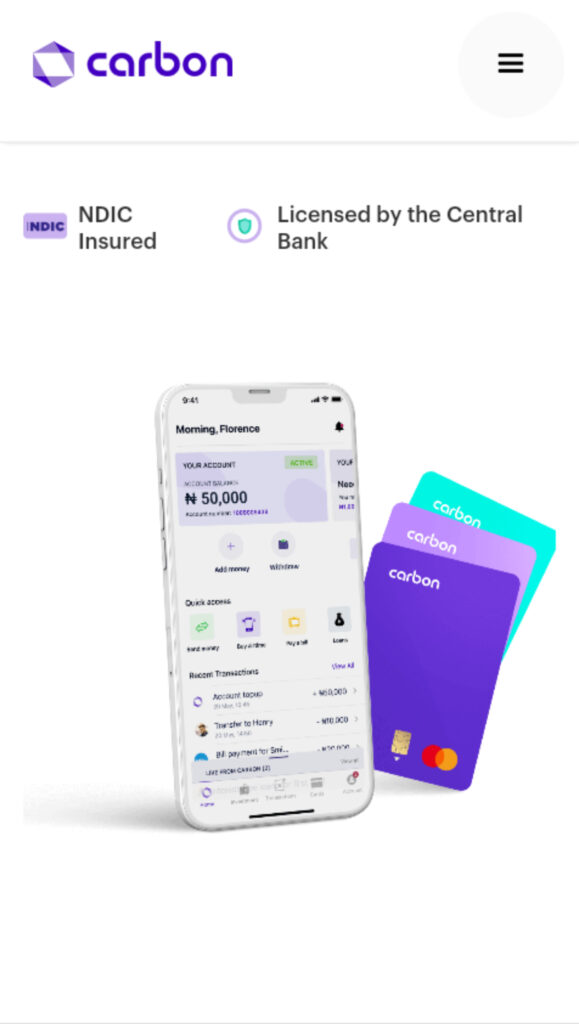

#1: MOBILE PHONE QUICK LOAN COMPANIES IN NIGERIA: PAYLATER

Paylater increases the credit access of people in Africa that are financially excluded/under-served through their automated lending service. Their loan decision is very fast as it happens within 15 seconds and with a successful application, you get your funds within 5 minutes. You do everything via your mobile app and you have to use the carbon app on google play store.

KEY FEATURES

-No collateral nor guarantor needed

-Designed for only short term loans

-Usual amount is N10,000 Naira

REQUIREMENTS

– Fully filled out application

-Android Phone

-Valid bank details with BVN number

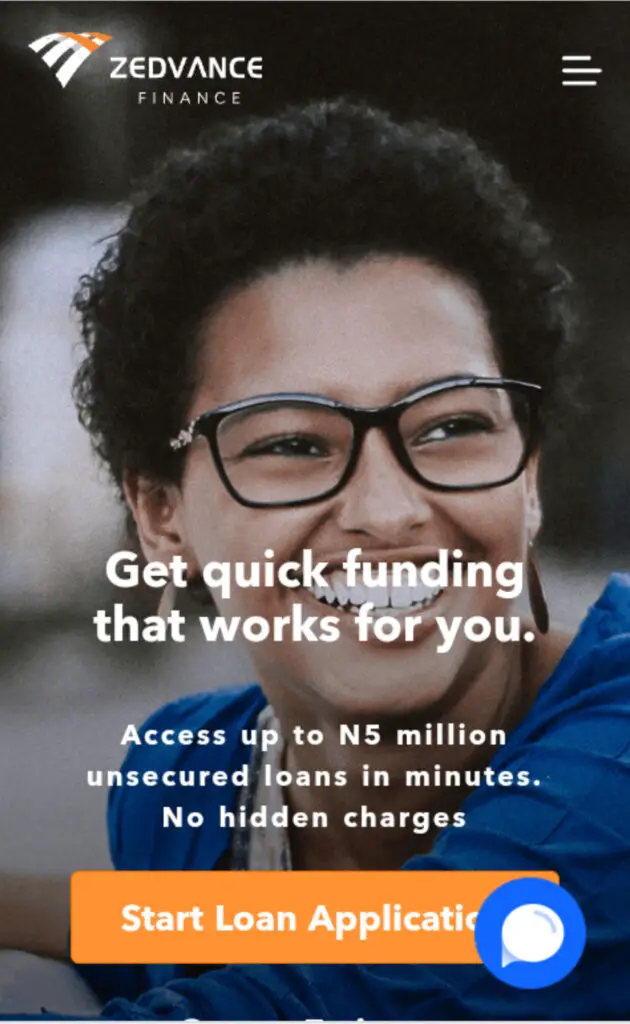

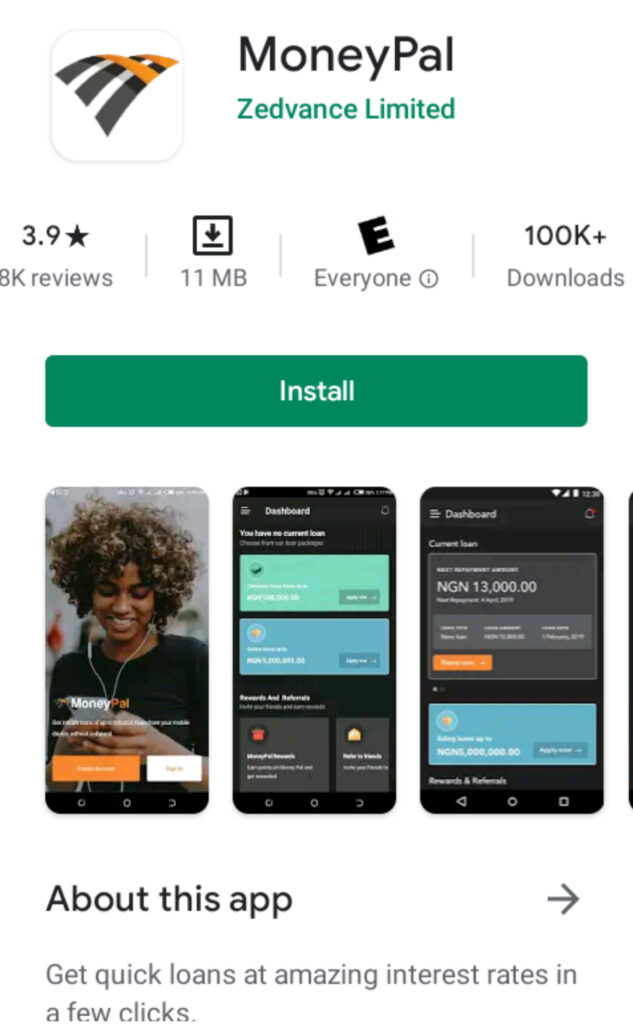

#2:MOBILE PHONE QUICK LOAN COMPANIES IN NIGERIA: ZEDVANCE

Zedvance provides quick loan to customers anywhere, anytime with no hidden charges. You can register via Moneypal app, website or via whatsapp by chatting with Zee and get your loan credit alert within 10 minutes. You can download the app here.

KEY FEATURES

-Collateral free loan

-Up to N5million naira loan available

-Quick loans within minutes

REQUIREMENTS

-Smart phone and internet

-Register with your phone number linked to your BVN number

-Personal details

#3:MOBILE PHONE QUICK LOAN COMPANIES IN NIGERIA: QUICKCHECK LOAN

Quickcheck loan company focuses on the underserved and offers digital financial services using a machine learning to instantly evaluate loan applications and predict borrower’s behavior. Requesting for a loan and getting approved is done online via their mobile app or website platform. Their platforms provides optimum security to data electronically via PCIDSS complaint.

KEY FEATURES

-Up to N200,00 naira loan available

-No hidden charges

-No guarantor or collateral required

– Always available 24hrs to give support

REQUIREMENTS

– Fully filled out application

-Android Phone

-Valid bank details

Also, read: CAR INSURANCE COMPANIES IN NIGERIA

#4:MOBILE PHONE QUICK LOAN COMPANIES IN NIGERIA: IRORUN

Irorun as the name implies means peace in Yoruba language and this company claims to provide customers peace of mind with their fast loan access. Their app is designed for savings for customers and also lending to customers, and they provide optimum security to data electronically via PCIDSS complaint. Sign up in few seconds and get loan after approval in minutes. You can download the app here.

– Start up loan amount is N2,500 and increases with good payback record

– Loan range available is from N5,00 to N50,000

– You must be 21 years old to be eligible

-Length of loan is between 60-180 days

-No collateral, guarantor nor document needed

REQUIREMENT

– Personal details required

– Employment details required

– A valid debit card

– BVN number is Mandatory

#5:MOBILE PHONE QUICK LOAN COMPANIES IN NIGERIA: CREDPAL

Credpal is an online loan company that gives financial access to their customers everywhere in Nigeria in the form of cash and credit card loans. Their loan decision is very fast as it happens within 15 seconds and with a successful application, that you get your funds within 5 minutes. Everything is done via their mobile app. You can download the app here.

KEY FEATURES

-Up to 5 million Naria loan provided

-Point of purchase loan

-Fixed monthly installment payment plan

-Repayment history determines interest rate

REQUIREMENTS

– Fully filled out application

-Android Phone

-Valid bank details

-Card payment details

#6: MOBILE PHONE QUICK LOAN COMPANIES IN NIGERIA: BOROME

Borome like any other mobile loan company gives fast loan to their customers and are focused on driving financial inclusion to everyone in Nigeria. Their platform is secured as they work with financial institution and are using enterprise grade server security and your card information is stored on PCI DSS compliant servers. You can download their app here.

KEY FEATURES

– Low interest rate

– Up to N100,00 naira instant loan

-Short term loans

– Repayment within 52 weeks

-No paper work

– Get your first loan within 5 minutes

– Get higher loan amount when you repay your previous loan

REQUIREMENTS

– A smart phone is mandatory

– BVN number is needed

– Registration

– Complete profile

CONCLUSION

Having the opportunity to have access to instant loan is a sign of relief to a lot of Nigerians, especially those that don’t qualify for bank loans. There are a lot of instant loan via mobile phone companies in Nigeria currently and a lot more is being created. There are keys areas to focus on while deciding the company to work with and be sure to do your proper background check.